Ep. 217 – The Inflation Conundrum: Unravelling its Causes and Consequences

Inflation… What is it, why is it a problem and what causes it?

Highlight segments:

2.25 – Property prices rising, rate to stay on hold

5.56 – Why inflation is required

9.52 – Productivity at its lowest level in 30 years

14.27 Unit labour costs rising faster than ever

19.22 – What is the level of unemployment and interest rates we need to maintain inflation within the target band?

35.16 – Gold Nuggets

Mike hosts this this exciting special episode and the Trio work to demystify this economic phenomenon, along with some of the terms that we often hear in the news.

Inflation is also known as the CPI, short for the Consumer Price Index, because this is the index that records the changes in pricing of all the goods and services in the economy.

So, if someone says CPI they are referring to the rate of Inflation.

Dave points out that wages growth is also a significant part of the picture and our RBA is attempting to engineer our wages growth to slightly outstrip economic growth, (aka inflation), our standard of living will then improve as our incomes outstrip the cost of goods and services that we are buying.

Bringing economic growth back into the target band is a delicate balance as our RBA aim to avoid a recession and aim for a ‘soft landing’, as Mike puts it.

Dave steps through our listeners in a structured, easy-to-comprehend way.

In General – Inflation can be caused by several factors, including these four key ways which we will place in the order of which they have occurred in current times:

- Monetary Inflation: When there is an increase in the money supply in the economy, it can lead to inflation if the production of goods and services does not keep pace with the increased money supply. This is often influenced by central banks and their monetary policies.

COVID times this has been the massive government stimulus to infinity, money printing and reducing rates to zero or below.

Historically inflation has sat at 2.5%, although our inflation levels prior to 2021 were particularly low. In fact, as Dave points out, inflation was concerning on the ‘low side’ at this time. Productivity was the key concern at the time, and for six years our RBA held rates at very low levels to stimulate spending.

Dave walks listeners through the hefty rate of inflation increases that we’ve been experiencing for the past 18 months and Cate points out some important context about other previous low interest rate periods.

Mike quizzes Cate on her experience as an investor spanning more than two decades and Cate shares her teenage memories about the 1988/1989 impact on her family during a really tough economic period.

Mike tackles some of the pressures the RBA face in relation to fiscal policy (government) vs monetary policy (the bank). Dave shares with our listeners some of the ways that our government influenced the economy, particularly through the COVID period. From quantitative easing to the provision of the funding facility to the lenders, over-stimulation is now the issue that the RBA are now tackling.

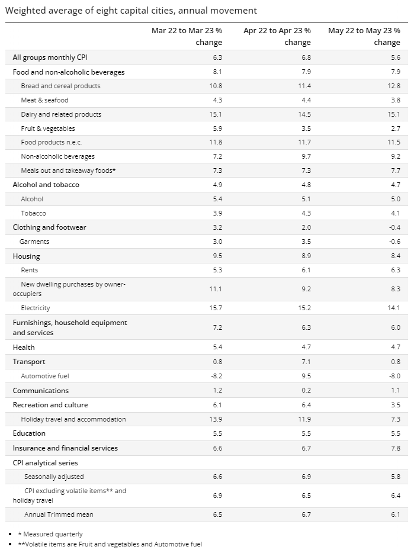

Cate steps through CPI from the chart below and she sheds light on some of the non-permanent inflationary pressures, and also those that can be attributed to external factors such as the Ukraine invasion and COVID lockdowns.

Mike touches on “YOLO”, (you only live once) challenges following the lockdown and concedes that our appetite for lifestyle experiences such as travel are working against the RBA’s actions to tame inflation. As Dave coins it, “Revenge Spending”.

- Cost-Push Inflation: This happens when the cost of production, such as wages or raw materials, rises and businesses pass on those increased costs to consumers in the form of higher prices.

Covid times this was the breakdown of supply chains due to closed borders, the lack of availability of workers and reduction in trust between many western countries and China in particular, then the Russian invasion of Ukraine all pushing up the costs of supply.

The prices of goods increased strongly as retailers pass through the costs associated with supply chain disruptions and higher shipping prices which are now starting to subside.

Meanwhile, the cost of building a new house – the largest component of the CPI basket – increased at its fastest rate in more than a decade due to a boom in construction activity (due to government stimulus for building new dwelling and renovations for the first time ever) and record inflation in building material prices.

- Demand-Pull Inflation: This occurs when the demand for goods and services exceeds the available supply, leading to an increase in prices.

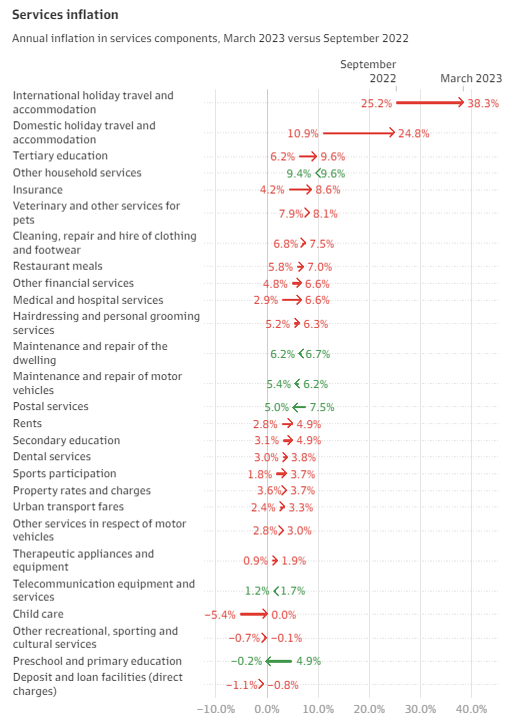

In the March 2023 quarter – Services annual inflation recorded its largest annual rise since 2001 is the real worry now for the reserve bank.

“This happened due to all the stimulus, increased personal savings, growth in property values and desire to travel again and revenge spend that happened in 2022 and into 2023.”

- Expectations: If people anticipate higher future prices, they may adjust their behaviour by demanding higher wages or raising prices, thereby contributing to inflation.

“This is the final phase that the reserve bank is very wary of which leads to a wage price spiral, entrenched expectations for prices, especially for services to continue to rise at this faster rate”, says Dave.

Mike shares a frightening example of post WW1 hyper-inflation in Germany. Four to five marks to the US dollar increased to a trillion marks to the US dollar. Mike regales some other horrendous real-life stories.

Cate and Mike chat about the impact of a high-inflation environment, from stagflation to vulnerability for those who don’t own assets. Cate talks about the contingent who aren’t likely to be negatively impacted by inflation.

What is the negative impact inflation has on the economy and individuals?

While moderate inflation is considered a normal feature of a healthy economy, high or hyper-inflation can have adverse effects.

- It erodes the value of your savings relative to cost of goods, services or asset prices such as housing,

- Reduces purchasing power because every dollar you earn is reducing in value relative to the prices of goods and services,

- Distorts economic decision-making meaning governments and individuals start to make different, unusual or abnormal decisions, and

- This can create economic instability and lead to a reduce standard of living for the country citizens.

And our gold nuggets……

Dave Johnston’s gold nugget: we have to be prepared to deal with changing financial circumstances on our journey… from those we can control, to those we can’t. Succeeding, (and thriving) all comes down to your risk mitigation strategies and buffer accounts. We need to understand these things are a possibility, and we need to plan for them.

Cate Bakos’s gold nugget: We are going to share our comprehensive show notes in our Resources tab on our website here.

Resources:

If you enjoyed this episode, you may also enjoy these:

Ep. 10 – Why your approach and assessment of risk is paramount to your property success!

Ep. 35 – Emotional decision-making: #5 of the top seven critical mistakes

Ep. 155 – Plotting Australian property market movements from 1970 to now

Ep. 158 – How interest rate cycles have impacted the property market since 1990