Ep. 306: How to Increase Borrowing Power – How Kids, Rate Cuts and Variable Income Impact Property Buying Potential, Equity Access & Refinance

Ep. 306: How to Increase Borrowing Power – How Kids, Rate Cuts and Variable Income Impact Property Buying Potential, Equity Access & Refinance

2.16 – Cate kicks off the episode with the first question: How much do kids affect your borrowing capacity?

5.55 – What is the borrowing capacity differential for single parents?

13.13 – How do borrowers tackle parental leave?

17.52 – What impact does a cash rate change have on borrowing capacity?

31.28 – What should borrowers do when they are on the edge of a promotion or pay rise?

39.51 – Parental leave and the return to work: Dave talks us through the protocol for those who have a portion of income associated with bonuses

46.36 – Gold Nuggets!

In this episode, Cate and Dave dive into how life circumstances and interest rate changes directly impact borrowing capacity when borrowers are applying for a mortgage.

Whether you’re planning to start a family, waiting for a pay rise, or watching the RBA closely, this episode unpacks what it all means for your property plans.

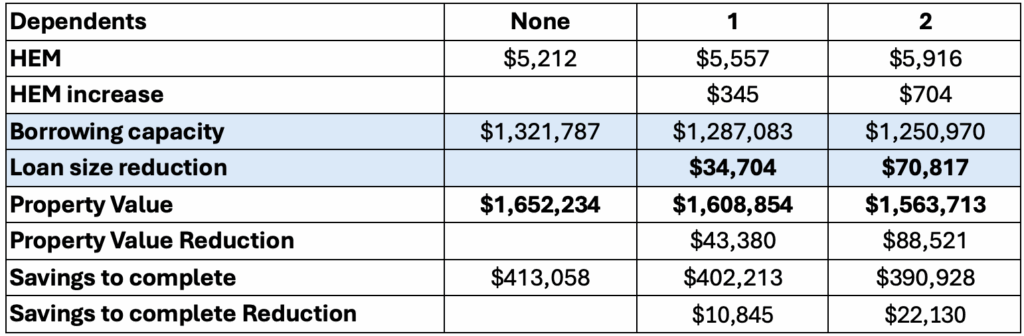

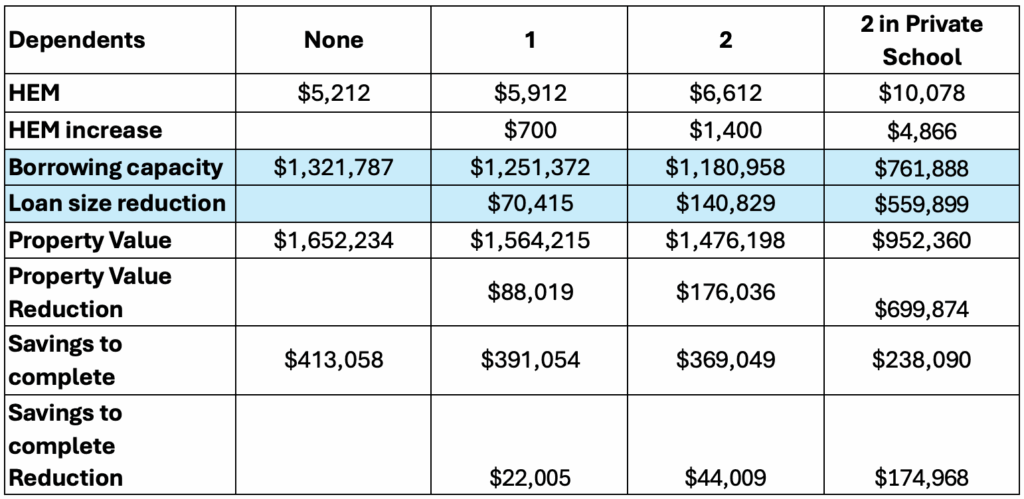

The episode begins by tackling a common question: how much do kids affect your borrowing power? Dave breaks it down with real figures. For a couple earning a combined $300,000, each child adds about $350 per month to living expenses under the Household Expenditure Measure (HEM), reducing borrowing capacity by roughly $35,000. But when you account for real-world costs—like childcare and private school fees—that impact can balloon to over $500,000 depending on your lifestyle choices. The takeaway? Kids can significantly reduce what lenders are willing to offer, especially if you’re covering higher education costs.

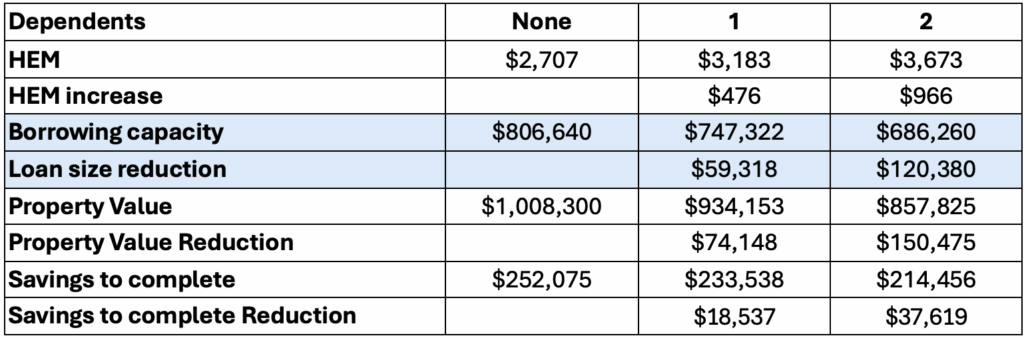

The conversation then turns to single parents, where Mike explains that HEM assumptions are more severe. Each child adds about $490/month to expenses, meaning a single applicant earning $150,000 may lose $60,000 in borrowing power per child. The financial pressure of being a solo breadwinner, combined with extra costs like babysitting or outsourcing household tasks, creates a tighter borrowing scenario compared to dual-income couples.

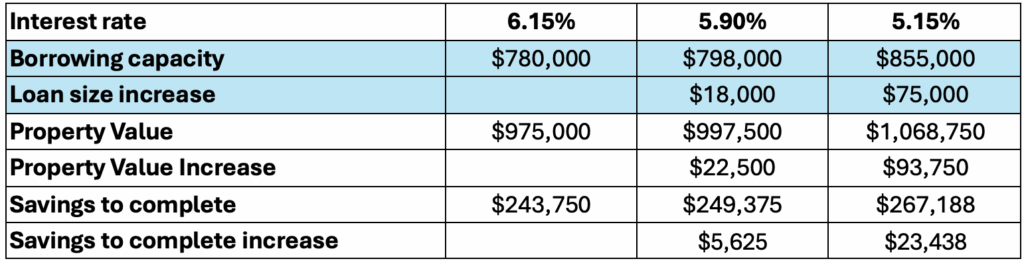

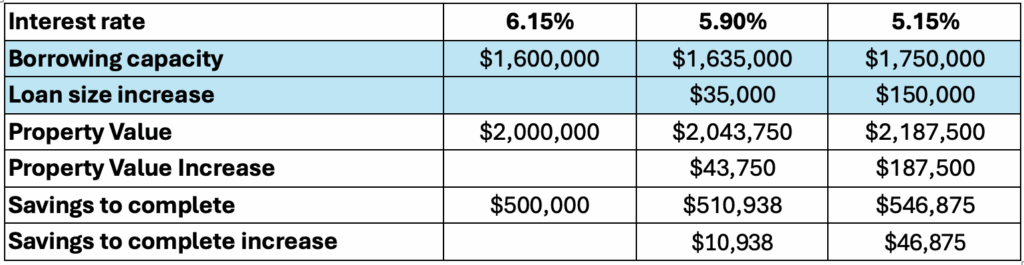

Next, the Trio explore the effects of interest rate changes. The recent 0.25% RBA rate cut increased borrowing capacity by $20,000–$35,000 depending on income and household structure. Dave highlights that if further cuts come through—as expected—borrowing capacity could rise by as much as $150,000, opening access to higher-value properties and likely fueling further property price growth.

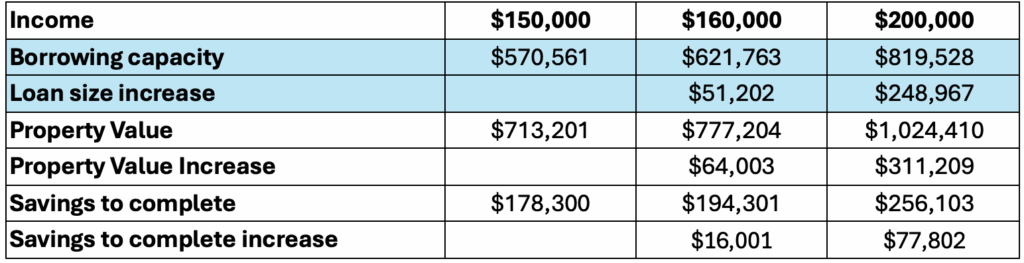

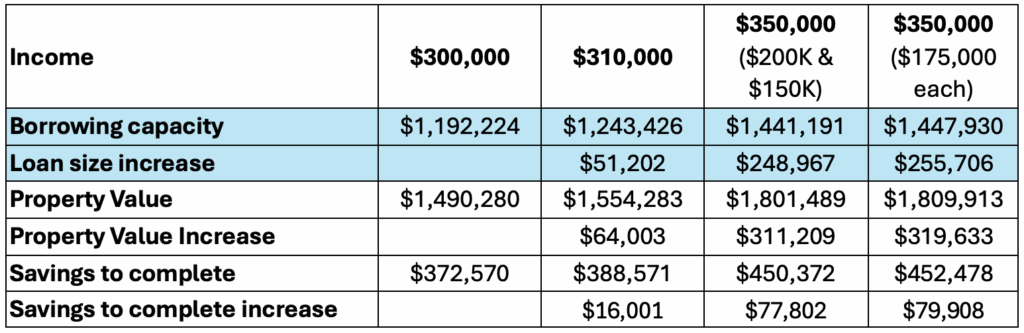

Mike also dives into how income boosts translate into borrowing power. A $10,000 salary increase can add about $51,000 to your borrowing limit—roughly five times the pay rise. However, benefits taper off once you hit higher tax brackets. For couples, even if only one partner increases their income or returns to work, the gains can be substantial.

Finally, Dave offers guidance for those considering waiting for a pay rise before buying. While higher income increases borrowing capacity, waiting too long in a rising market could mean missing out as property prices climb—potentially offsetting any gains from the salary bump.

Whether you’re starting a family, navigating single parenthood, feeling the challenges of lender servicing rules, or simply trying to get a better understanding of how banks assess incomes and assign borrowing capacity, this episode offers key insights to help you to navigate the lending steps more confidently and plan with clarity.

…. and our gold nuggets!

Mike Mortlock’s gold nugget: “What are you prioritising?” Mike reflects on one Dave’s comments about one of the most important things that a great, strategic mortgage broker will ask their client.

Cate Bakos’s gold nugget: Kids…. they are expensive. People are often hard on themselves when it comes to balancing building wealth and waiting it out while incomes are reduced while raising children. “Time with your kids is precious and they grow up really fast. Try to be kind to yourself.”

David Johnston’s gold nugget: Borrowers should think about whether there is variability with their income. They should disclose this as clearly as possible with their strategic broker, because the better they understand how income is earned, the better they can assist their client. “A good strategic mortgage broker will ask you lots of questions.”

Related episodes:

Ep. 34 No mortgage strategy – No.4 of the top 7 Critical Mistakes

Ep. 191 Risk management and the things that can go wrong when mortgage strategy is ineffective

Upcoming episode: #307: Listener Question – Analysing Ballarat’s Property Potential – The Pros, Pitfalls and Lifestyle Insights for Home Buyers and Regional Market Investors

Resources:

Here are the charts that Dave prepared for this episode, (all in chronological order)