Ep. 313: The History of Property Prices After Rate Cuts – 40 Years of Data, Houses vs Units, Capitals vs Regions & Predictions

0.54 – Cate kicks off the episode

7.44 – How is Melbourne’s current set of drivers different to past years’ economic conditions?

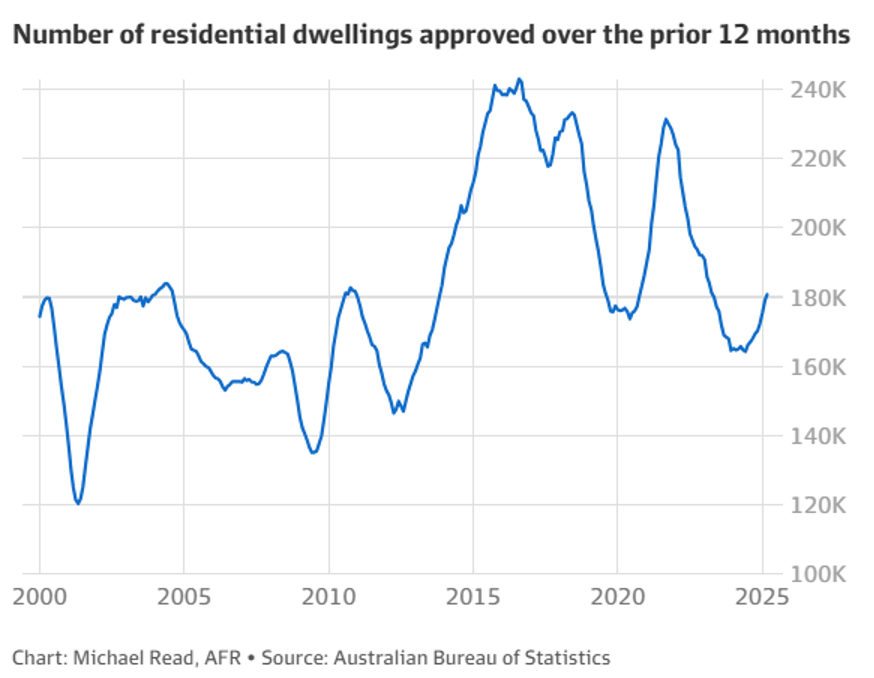

9.50 – Dave digests our housing approval figures and considers the current pipeline

11.45 – Why is 2025 poised to be a bit of a different year?

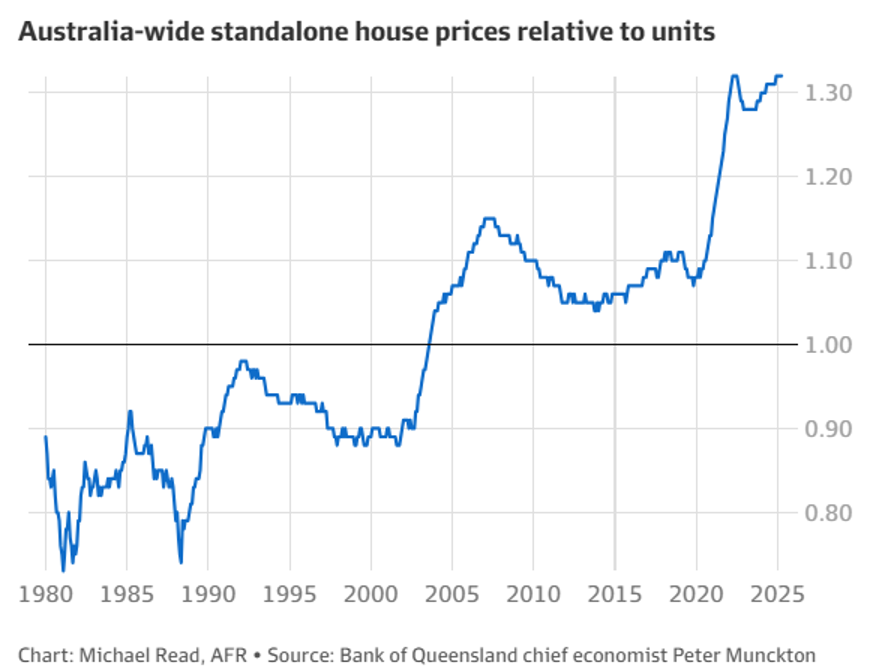

17.13 – Houses vs apartments…. Dave share some interesting observations

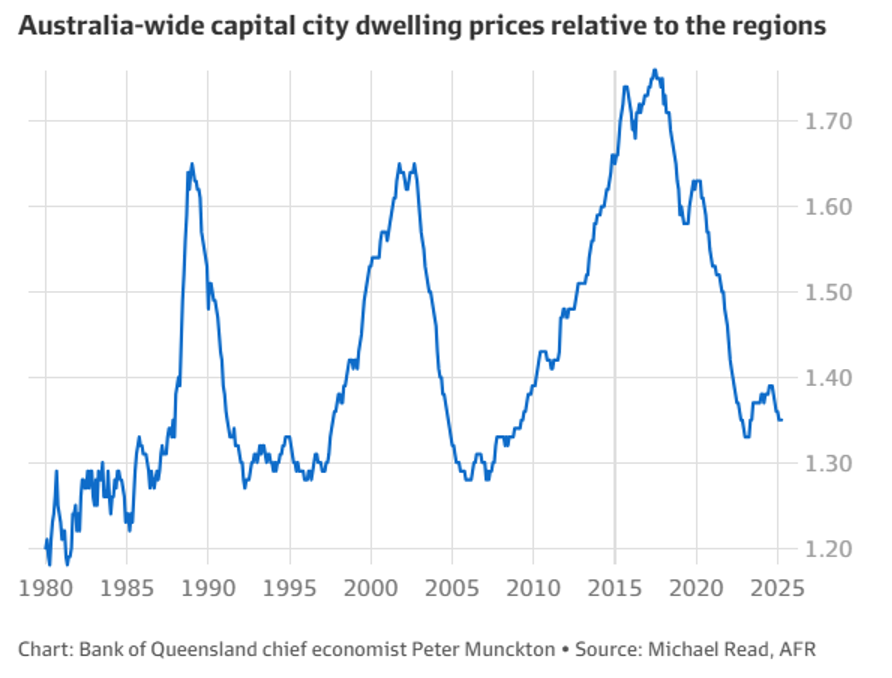

21.35 – Growth in capitals vs regions… what’s in store?

34.48 – Sneak peek into next week’s ep… Monthly market update

43.39 – Gold Nuggets!

🎙️ Welcome to another dynamic episode of The Property Trio!

Cate, Dave, and Mike reunite to unpack a hot question on many investors’ minds: Are we on the cusp of Australia’s next housing boom? Cate kicks things off by outlining seven key economic signals that are all pointing in the same direction — from falling interest rates to rising rents and tight supply. Whether you’re already in the market or still on the sidelines, this episode is one you can’t afford to miss!

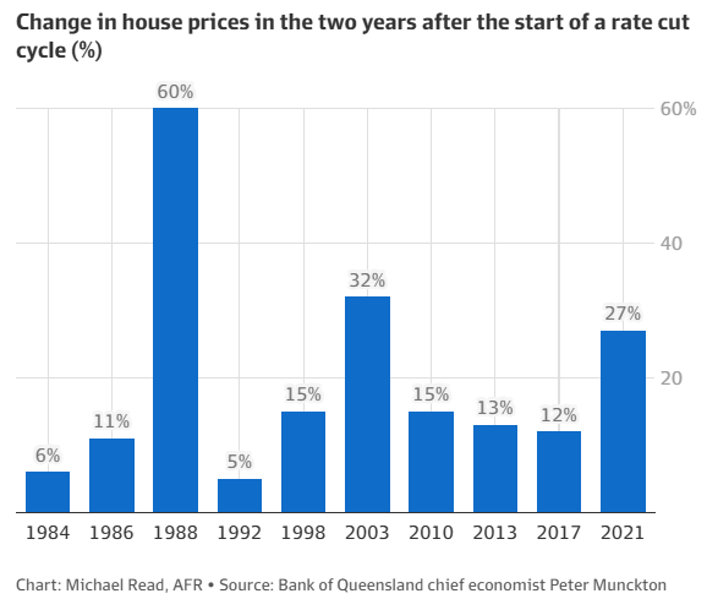

📉 Falling rates = rising prices?

Dave dives into a powerful piece of research by Peter Munckton from Bank of Queensland. He shares compelling data showing that historically, when interest rates fall, property prices tend to rise — and often by more than 10% in the following two years. Mike adds that while we may not see pandemic-style booms, the signs are certainly leaning bullish.

🏘️ What’s different this time?

Unlike previous booms fueled by deregulation or pandemic stimulus, this cycle is driven by low supply and strong demand. Dave highlights sobering ABS figures — with only 180,000 dwellings approved in the past year, we’re well below the build rates needed to meet population growth or the government’s ambitious targets.

👶 First home buyers charging in

The team explores the expanded First Home Guarantee scheme. With caps removed and eligibility widened, it’s already creating ripples — especially in the lower quartile of the market. But will it cause a price surge? Economists are split, with some warning that the policy could backfire by fuelling early price growth.

🏡 Houses vs Units: Can the gap close?

Dave notes that since 2020, house prices have doubled unit growth. But with affordability stretched and units offering better yields, could we see a swing back? The team debates whether apartments are due for a renaissance — particularly for price-conscious buyers.

🌆 Capital cities ready to rebound?

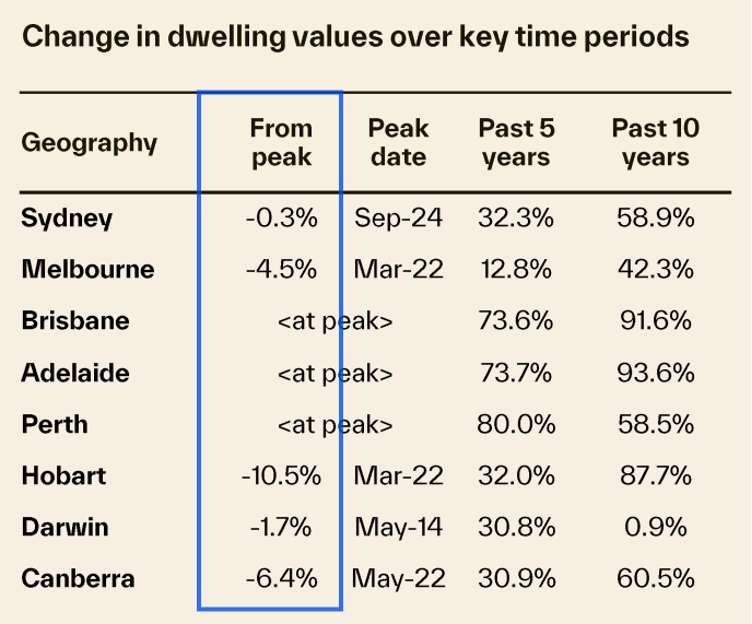

Regional Australia boomed post-pandemic, but now the spotlight could return to the capitals… or could it? Historical data suggests a cyclical pattern, and many capitals like Melbourne, Hobart and Darwin appear undervalued. Dave sees Melbourne as the sleeper, with 2026 poised to be its breakout year. Hobart and Canberra also show strong rebound potential.

📈 Mid-year prediction updates

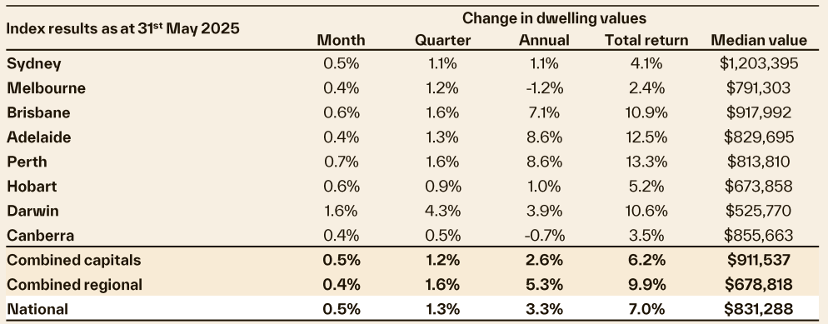

Cate, Dave and Mike revisit their 2025 forecasts. Dave supports 4.5% growth nationally by year’s end — and flags 2026 as the potential double-digit boom year. Cate and Mike still expect a solid 2025, but with more moderate growth compared to previous boom cycles.

…. and our gold nuggets!

David Johnston’s gold nugget: 2025 is shaping up as a better window of opportunity. Borrowing power has improved… but Dave believes 2026 could be an even stronger year for property price growth.

Mike Mortlock’s gold nugget: Are we heading towards a boom? Mike steps through the other capitals and he tends to agree with Dave.

Cate Bakos’s gold nugget: Cate focuses on the history of booms and busts and talks about the historical magnitude of each. Standing back and looking longer term, long-term active investors will have a different level of sensitivity about market movement.

Related episodes:

Ep. 295 The Trio’s Top Predictions for 2025 – What’s in Store for the Property Market?

Ep. 298 Is Melbourne’s Property Market About to Turn? A Data-Driven Look at What’s Next

Upcoming episode: #314 Market Update

Resources: