Ep. 249 – Market Update February 24: National vacancy rates drop to one percent?!

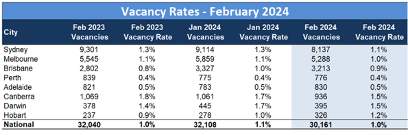

0.48 – Mike launches into the February market update – “One percent national vacancy rates. Who would have thought?!”

6.12 – Cate makes a bold prediction!

13.33 – The Novocastrian dares to ask the two Melburnians what is going on in their hometown

16.12 – Mike delves into Cate’s regional investment activity: what is the value proposition?

20.13 – Teaser from next week’s episode…a great first home buyer listener question

28.38 – Callout to CoreLogic… we want them to bring this data back!

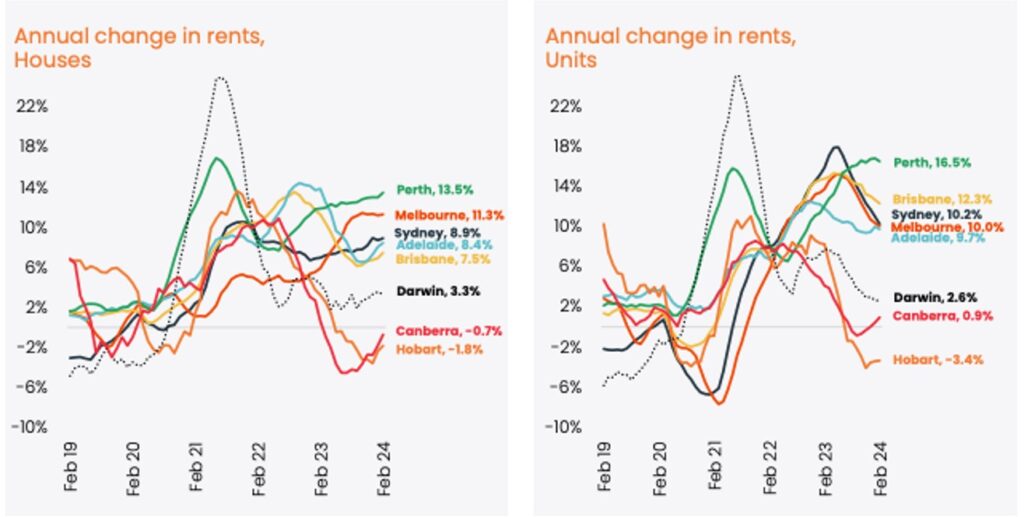

30.30 – Could rental growth eclipse capital growth this year? The Trio each weigh in

42.31 – Gold nuggets!

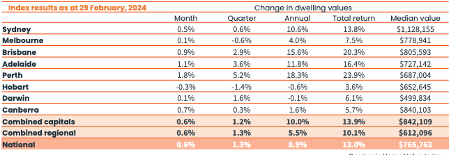

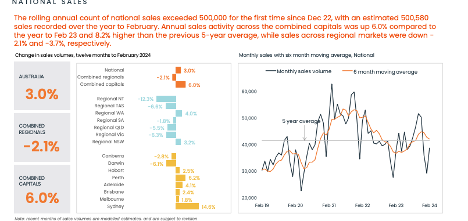

The February 2024 data is out, and the Trio circle the headline; the ridiculously tight vacancy rates nationally.

Mike compares houses and unit performance and ponders the drivers for unit purchasers. Dave delves into Perth’s outperformance and notes the predictions he and Pete made eighteen months’ prior.

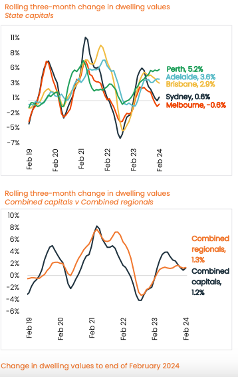

Is buyer confidence up? Cate sheds light on her own experience at the coalface. But how does data lag impact the figures, and will Cate’s prediction match the March data? Only time will tell…

What is happening with the regions? For the quarter, combined regions have outperformed the combined cities, but why? The Trio unpack this.

Mike dares to broach the question… “Where is Melbourne at?” The Novocastrian dares to challenge the proud Melburnians with this question, but they rise to the challenge and shed light on what is going on in their home city with investors.

And have the regions suffered to the detriment of Melbourne’s recovery? Not at all, but Cate explains the dynamics post-COVID. Cate also shares the value-proposition of houses in nearby regions versus apartments in Melbourne’s inner-east.

Vacancy rates are so tough on tenants right now and the Trio note that vacancies have tightened even further. From changed planning laws to talk of investor incentives, the jungle drums are beating. But sadly the Trio concur that conditions will continue to deteriorate until governments make a different kind of change.

Listing activity is higher, yet sales volumes reflect that buyer demand is meeting supply and this coming weekend is set to be a stand-out weekend for auction numbers. But what will post Easter, and early winter look like?

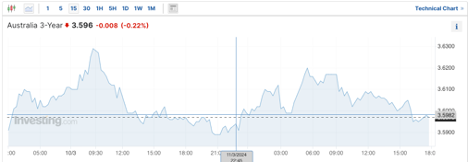

“We only need to talk about rate decreases and people go crazy”

Rental values have re-accelerated in 2024. Feb recorded the highest rental reading for the last eleven months.

Will rent growth outpace capital growth? The Trio weigh in… and they don’t all agree.

The three year bonds curve shows that the money markets are predicting three rate reductions as an average cash rate.

And… time for our gold nuggets…

Cate Bakos’s gold nugget: For any prospective tenants out there, you have to be prepared to differentiate yourself in this tight vacancy rate environment.

Dave Johnston’s gold nugget: This month suggests that so many data points are pointing towards a property price rebound this year, so if you are considering buying property, it’s time to get your ducks in a row. Narrow in on your strategy, arrange your pre-approval and be clear on the plan.

Resources:

If you’ve enjoyed this show, take a listen to these eps:

Here are the ones used:

Ep. 6 – What determines your property strategy?

Ep. 10 – Why your approach and assessment of risk is paramount to property success

Ep. 12 – Property Cycle Management

Ep. 18 – When to hold and when to fold

Ep. 60 – Why established properties out-perform

Charts sourced from Core Logic and SQM Research