Ep. 239 – Optimising Offset Accounts – Why You Should Pay Off Your Home Loan First & Other Mortgage Strategies to Create Wealth & Maximise Retirement

Ep. 239 – Optimising Offset Accounts – Why You Should Pay Off Your Home Loan First & Other Mortgage Strategies to Create Wealth & Maximise Retirement

>

Highlight segments:

2.00 – Mike introduces this week’s listener question

6.55 – Mike asks Dave if Ben can have his cake and eat it to, and Dave has an important question for Ben.

10.37 – “Dave, what stages of life do you typically see your clients facing these conundrums?”

15.05 – Cate’s simple solution sounds too good to be true, but can it be done? And what are Ben’s challenges. Dave weighs in with a detailed solution – it requires some intensive concentration though!

20.37 – Sneak peek into next week’s episode – our 2024 predictions

30.40 – Mike explores the impact of offset against principal and interest loans

35.40. – And our gold nuggets!

This week’s episode features a great listener question from Ben.

“Offset account question I am grappling with. I am nearing retirement and have three investment properties in NE Melbourne, two of which are IO and fully offset. Third is IO and partially offset.

I have a PPOR P&I loan with and offset account set up.

I continually go round the conundrum of whether to park my funds offset against investment IO loans or the PPOR P&I loan.

I fully understand the extra cash flow I get by not paying interest on the IO loans, and effectively have the rent as income (taxable).

And offsetting P&I PPOR actually makes no difference to my P&L unless I do something downstream – sell or refinance. Any thoughts?”

Cate offers the layman’s view on Ben’s predicament.

Can Ben have his cake and eat it too? Dave would suggest that Ben 100% offsets his home loan first, and then he would target placing his surplus funds into the highest interest rate investment loan offset account. Switching his home loan to Interest Only is another good option.

Mike prompts Dave with a question: “What stages of life do you typically see your clients facing this conundrum?” Cate weighs in with some insights based on recent economic and banking changes, relating Ben’s conundrum to some of her client’s questions.

When APRA stepped in, requiring banks to set home loan rates lower than investment rates, things started to change for a few investors. Tune in to hear more…

Cate’s simple solution hinges around refinancing his home loan to Interest Only, but is it that easy? Dave weighs in with some of the challenges Ben may face.

Dave has a technical solution, but it’s not easy and will require some intense concentration!

Mike ponders; can refinancing the existing debt to reduce the minimum loan repayment commitment help Ben’s case? Cate and Dave step through the pro’s and cons of the various approaches on option to Ben, highlighting the tax benefits, interest rate differential and long-term benefits.

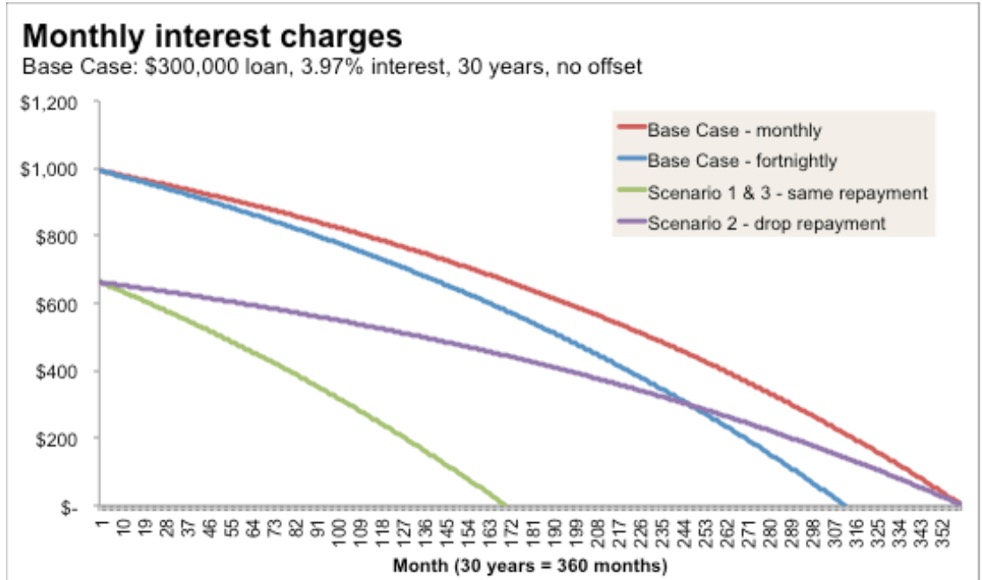

And the Trio shed light on the benefits of offset against Principal and Interest loans

….And our gold nuggets!

Dave Johnston’s gold nugget – If Ben can’t refinance and can’t go to IO, Dave highlights the important points for Ben to consider. Sometimes going backwards from a cashflow perspective isn’t always the worst case scenario. Looking forward, doing the maths and not losing sight of the bigger picture is important.

Cate Bakos’s gold nugget – Visibility is everything. If Ben has a dashboard and can get a sense of timeframes, he will get a better sense of perspective. His overall portfolio will likely hold him in good stead, but in the meantime he could do a stocktake of his current discretionary spending, and conduct a health check on his current home loans.

Mike Mortlock’s gold nugget – There is no simple answer, but there are a number of ways that he can do this. Knowing what the banks will allow is important too.

And if you have enjoyed this episode, we recommend you listen to these eps:

Ep. 9 – Why your mortgage strategy is more important than your interest rate?

Ep. 48 – Offset accounts – God’s gift to Mortgage Strategy!

Ep. 55 – All things property tax – how to understand your deductions at tax time

Ep. 207 – All things property tax – how to understand your deductions at tax time

Resource: from Money School

https://www.moneyschool.org.au/property/pay-mortgage-use-offset-account/