Ep 213: Exploring How Government Policy Shapes Investor Behaviour – Decoding the Queensland Land Tax Ripple Effects

Mike’s planning for this episode has Cate and Dave laughing… our newest muskateer is challenging the Trio with his cheeky script. But they won’t fall prey to his tricks.

Today’s episode is all about some insightful data that Mike and the team at MCG uncovered about changing investor behaviours during the Queensland land tax proposed changes of 2022.

“Anecdotally, (investors) were avoiding Queensland when they were legislating the land tax changes.”

Mike’s data captured three significant segments in time: pre, during and post the land tax legislation and eventual repeal.

“I was pretty unimpressed as an investor,” says Cate, who considered selling her Queensland property at the time.

Cate sheds light on the attitude of investors at the time of the legislation changes. Buyer behaviour was a reflection of the concern about increased land tax obligations.

Focusing on the data – as Mike points out, 40.9% investment purchases in Australia were in Queensland prior to the legislation being enacted.

“During that 98 day period, the figure dropped to 33.6%, representing a 17.8% drop”, says Mike

Cate queries some of the other variables that may have impacted the data, including interest rate increases, COVID lockdowns.

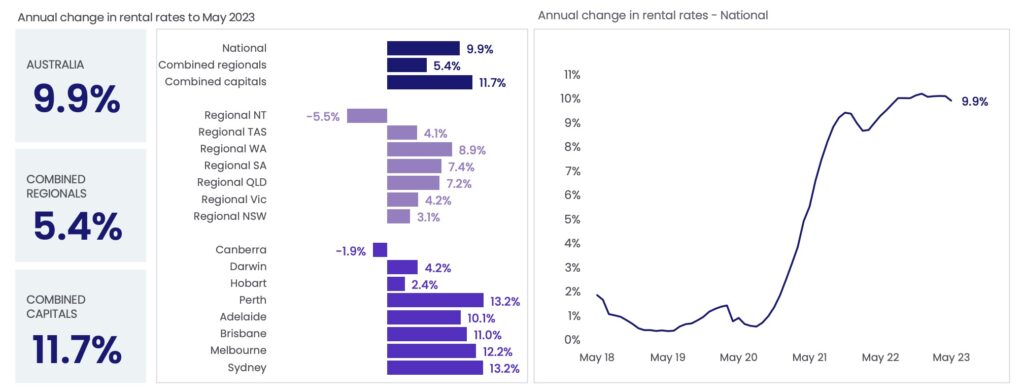

Dave asks Cate about the impact of this legislation on the rental market. The volume of sales would have no doubt eroded the rental stock, and as Cate points out, Queensland was enormously impacted by homelessness.

Mike also sheds light on how the State Government taxes are offset by Federal Government negative gearing benefits.. Tune in to hear more…

The Trio are clearly not supportive of the Queensland Government’s land tax move on land tax in 2022.

Post-the repealed date, the figure only rebounded to 34.73%, a figure that still signals that investors were spooked. Combined with the Greens’ policies, the investor market are cautious, particularly in Queensland. And as Dave noted, a lag effect can last a long time.

Victorian land tax changes, combined with tough rental reforms and a supply/demand imbalance will likely erode Victorian rental supply and the two resident Victorians in the trio discuss this. Household formation changes, combined with Air BnB and investor fears are playing havoc with Victoria’s investor stock levels.

As Cate says, “it goes beyond assuming that it will net itself out.”

Mike discusses the ‘build to rent’ and superfund theories that are populist decisions presently. The conundrum is that the conditions are just making things tougher for renters. From developers to local council to The Great Australian identity….

Cate sheds light on some current Victorian government established property acquisitions and the challenges that are associated with high rise social housing stock. She also chats about the current vacancy rates and how historically significant our current vacancy rates are.

As far Queensland’s land tax legislated land tax changes boded; “It’s misguided and it has unintended consequences”, says Dave.

Cate discusses the need for continued investor participation to quench the current renter thirst. Combined with limited control over this asset class, the Trio agree that things are precarious for the current rental housing crisis.

Lastly, Mike feels that Queensland didn’t acknowledge that they got it wrong with the 2022 policy.

Moving on to our gold nuggets!…

Cate Bakos’s gold nugget: For our investors who are wondering how all of this legislative change impacts them. Check your legislation and find out all about market rent, how regularly you can increase rent, and what new policies impact you.

Mike Mortlock’s gold nugget: It’s very unpopular to discuss positive roles that investors provide in society. It’s a tough juggle socially for many who are balancing the need to grow their wealth with the altruistic drive to provide housing.

Resources:

If you enjoyed this episode, you may also enjoy these:

Ep. 55 – All things property tax

Ep. 87 – Optimising tax deductions

Ep. 108 – Understanding my land tax

Ep. 119 – How supply and demand dictates market movement, part 1