Ep. 206 – Breaking free from buyer’s paralysis: Mastering the art of property decision-making and conquering the fear of buying before a better option

Ep. 206 – Breaking free from buyer’s paralysis: Mastering the art of property decision-making and conquering the fear of buying before a better option

This ep is all about FOBBABO, an acronym Cate made up years ago. It stands for Fear of Buying Before a Better Option.

She coined this phrase a while back when buyers started having second thoughts after an ideal property came along.

This episode is dedicated to the trick buyers often play on themselves… some of the reasons why, things that amplify FOBBABO, why it can be dangerous, and ways to tackle it when it happens to you.

Dave hosts this exciting episode and explores with Mike and Cate some of the other psychological challenges buyers face, from FOMO (Fear of Missing Out), to ‘the winner’s curse’, an segment that Dave, Cate and Pete covered back in episode 94.

Dave asks Cate to share how FOBBABO usually manifests and becomes obvious to a buyer’s agent, and Cate also sheds light on the pro’s and cons of FOBBABO, which market cycles it usually strikes in, and why the media can be quite unhelpful for those who are struggling with this fear.

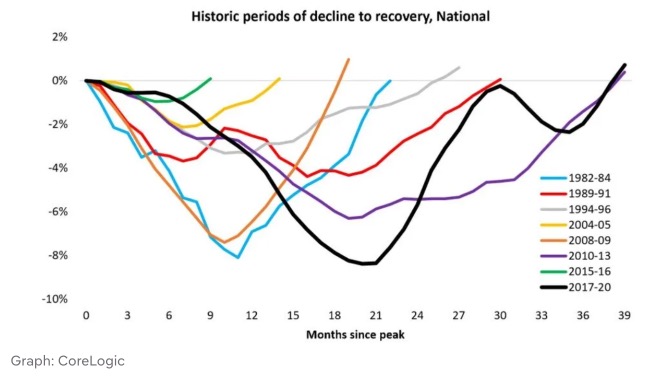

Dave also asks Cate to delve into some of the painful lessons that FOBBABO can create, and the trio speak about the difference between our most recent property downturn and previous downturns. Dave shares his insights on the impact of inflationary pressures, rising interest rates and in particular, diminished borrowing capacity for many buyers as a result of the rate hikes. This time, FOBBABO presents even more dire risks for some buyers… tune in to find out more!

The trio talk about some of the ways that buyers can limit the negative impacts FOBBABO can cause and Cate talks listeners through her ‘reverse search engine’ exersise. This not only helps give perspective for buyers who are feeling the threat of FOBBABO, but also enables them to construct a clear feasibility study that highlights not just the likely types of eligible properties, but their frequency of sale also; an essential element to note for anyone who is concerned about a moving market.

The trio share eight tips to ward off the chances of FOBBABO biting… check out the show notes below.

And… our gold nuggets!

Mike Mortlock’s gold nugget is all about buyers making sure they have their brief nailed down. The reverse search engine exercise caught Mike’s attention and he encourages our listeners to utilise this tool when it comes time to circle in on their purchase plans.

Cate Bakos’s gold nugget relates to the importance of taking action. Buyers have to be informed to be prepared to pull the trigger…. but once they have made the decision to buy, they just have to go for it!

Resources:

- Get a clear understanding of their borrowing capacity and the impact of rate rises (they can get a sense of the timeline they may need to work to)

- Make a clear list of essential criteria for your home/investment

- Conduct a reverse search engine exercise to determine how ‘frequently’ your ideal property comes up for sale in your given areas. Cate – can you tell our listeners how this is done?

- Watch the auction results and keep an eye on the segment of the market you are keen on

- Choose commentators or economists to follow and don’t listen to media or white noise

- Don’t tell all and sundry you are buying. There will always be that nosy friend or annoying aunty at the bbq who has an opinion on how you should try to time the market

- Familiarise yourself with market downturns and understand how long they last, how strong they dip, and what the signs of recovery are

If you enjoyed this episode, we suggest you tune in to these eps!

Ep. 35 – Emotional decision making

Ep. 80 – How to combat your naysayers and make successful property decisions

Ep. 82 – Goal setting fundamentals for property success